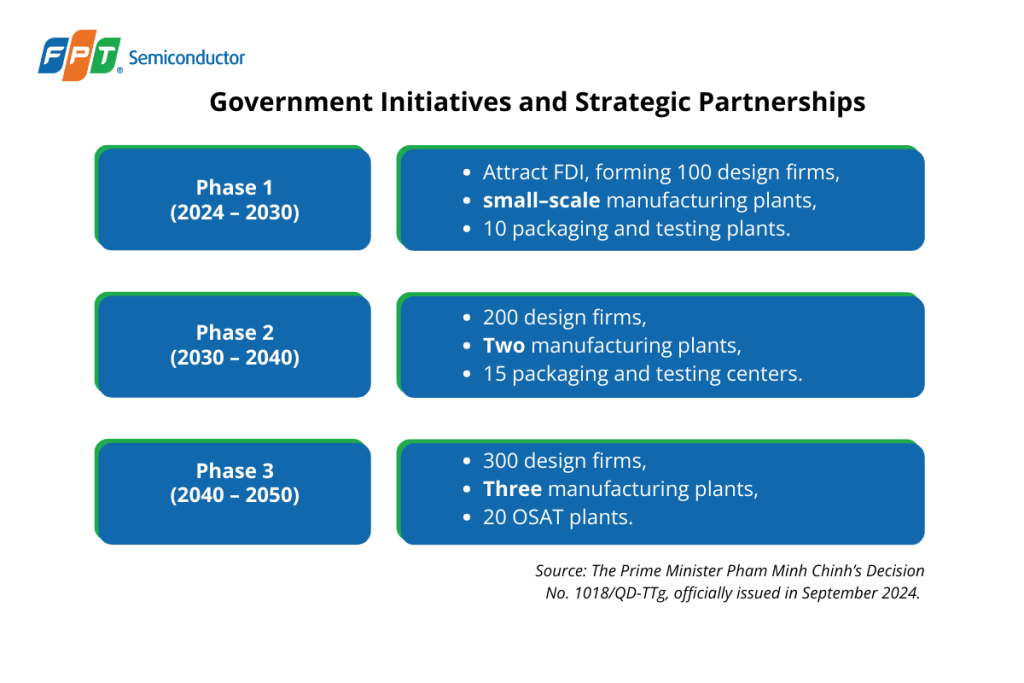

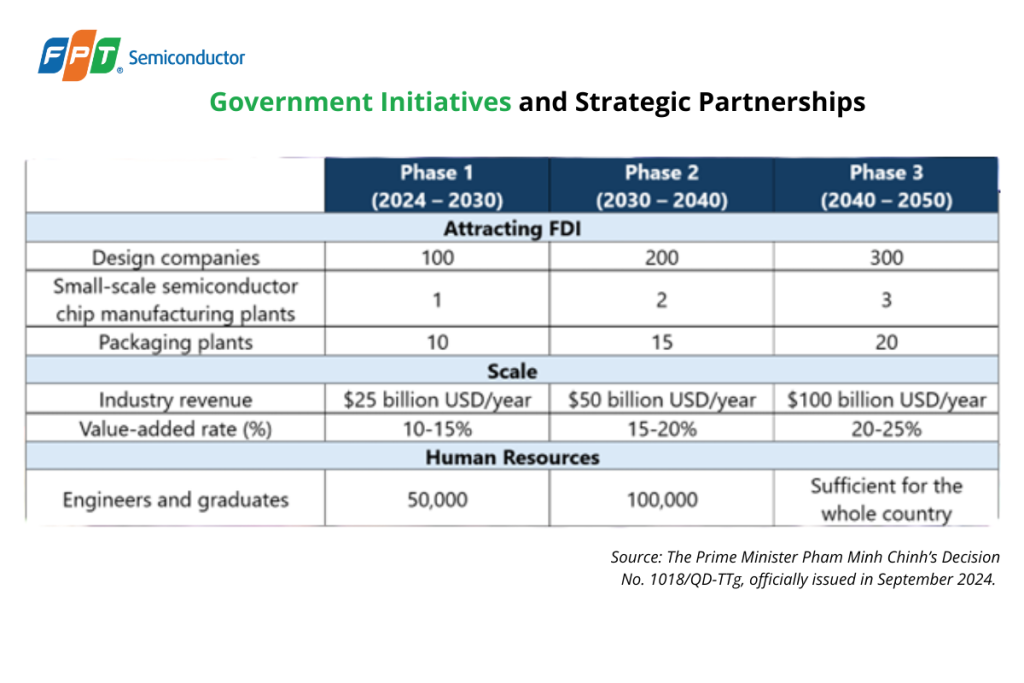

In September 2024, Vietnam took a bold leap toward the future by unveiling an ambitious national strategy to become a global semiconductor hub by 2050. Under Decision No. 1018/QD-TTg signed by Prime Minister Pham Minh Chinh, the “Strategy for Vietnam’s Semiconductor Industry Development through 2030, Vision to 2050” was officially launched. This comprehensive roadmap breaks development into three phases, including 2024–2030, 2030–2040, and 2040–2050, with targeted milestones in chip design, manufacturing, and testing infrastructure.

But just months later, a major disruption emerged.

In April 2025, President Donald Trump announced a sweeping set of 2025 Trump tariffs, including a staggering 46% duty on Vietnamese imports. For Vietnam’s fast-growing semiconductor industry, this move introduces significant headwinds—impacting trade, foreign investment, and future competitiveness.

So, what does this mean for Vietnam’s semiconductor ambitions?

Vietnam’s semiconductor industry under 2025 Trump Tariffs

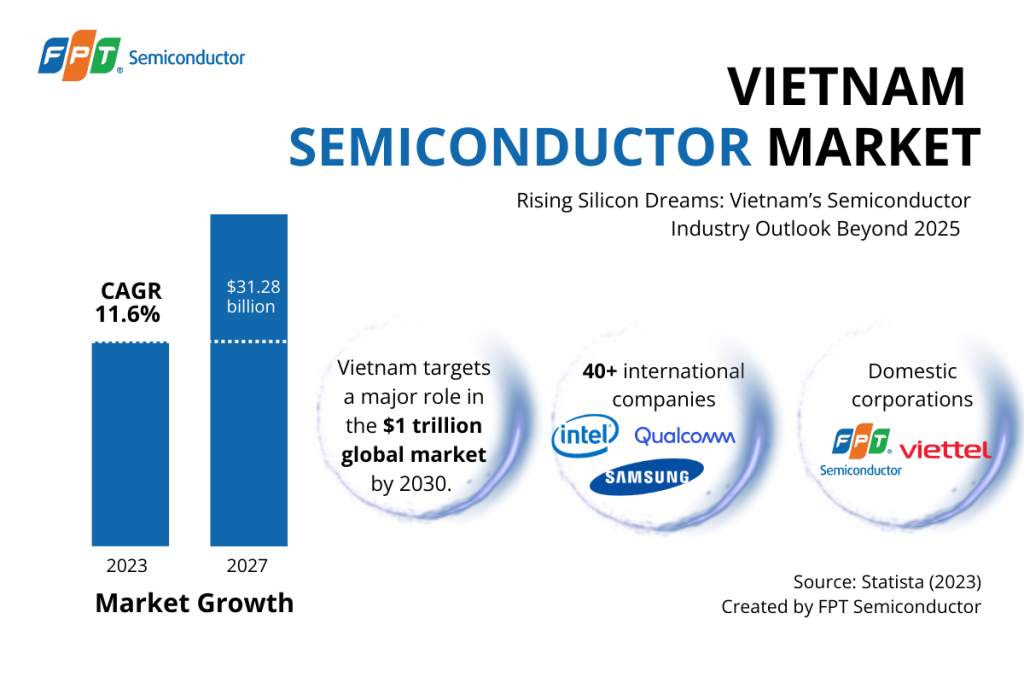

Vietnam’s semiconductor industry has steered by strategic governmental policies, which increases the Foreign Direct Investment (FDI), and a rising demand for chips across industries. With an estimated market value of US $31.28 billion by 2027 and a compound annual growth rate (CAGR) of 11.6% between 2023 and 2027, Vietnam is rapidly positioning itself as a leading player in the global semiconductor field, according to Statistia (2024). However, the recent imposition of broad 2025 Trump tariffs by President Donald Trump in April 2025, including a 46% duty on Vietnamese imports, poses substantial challenges to these aspirations.

In this context, it indicates that If Trump’s massive 46% Vietnam tariffs come into effect on April 9, it will lead to an extensive influence on Vietnam’s economies across sectors from exports, economic growth and Foreign Direct Investment (FDI) inflows.

In terms of exports, the US has been Vietnam’s largest export field, making up for 30% of total export turnover as $136.6 billion in 2024 and accounting for 26% of GDP. Particularly, 46% tariff on Vietnam could increase prices for products when being exported into the US market while lowering Vietnam’s competitive advantages against countries such as India, Mexico and China.

Impact of the 2025 Trump Tariffs

Foreign Direct Investment (FDI) in Vietnam’s Semiconductor Industry

Currently, Vietnam has witnessed significant investment of FDI within its semiconductor ecosystem. For example, Intel’s assembly and testing facilities based in Ho Chi Minh City is one of the largest international operations, which is expecting the total export value from Vietnam to reach $100 billion over a 19-year period. Meanwhile, in late 2024, Amkor Technology has also invested more than US $1.07 billion in Bac Ninh for the packaging facilities in Northern part of Vietnam.

With the newly imposed tariff, it threatens to erode cost competitiveness—particularly if rising chip prices become inevitable and it could disrupt the order flows, potentially hindering production and slowing the company’s growth trajectory.

Harmonized System (HS) codes for Vietnamese exports in rare metal and semiconductor components under US tariffs

According to the Agency of Vietnam General Confederation of Labour, the rare metal and important semiconductor elements have impacted due to the Trump tariffs.

According to Vietnam’s Ministry of Finance and Customs Department (April 4, 2025), the U.S. tariff list spans 37 pages of goods, including high-value exports in semiconductors and rare earth metals. Affected HS codes include:

- Core chip components: diodes, transistors, thyristors, triacs, optical isolators

- Key raw materials: gallium, indium, niobium, germanium, manganese, etc.

These materials are crucial for producing smartphones, AI chips, EVs, and 5G infrastructure—making the tariffs a direct hit to Vietnam’s ambitions in tech manufacturing and global supply chains.

Opportunities for Vietnam’s Semiconductor Companies

Despite the immediate challenges posed by the 2025 U.S. tariffs, Vietnam’s semiconductor industry holds significant potential for long-term growth and global integration. Key opportunities include:

Increase in export opportunities to the U.S.

The imposition of tariffs necessitates a strategic pivot towards alternative markets. Vietnamese semiconductor companies can explore burgeoning opportunities in Asia, Europe, and the Middle East, regions experiencing increasing demand for semiconductor components. According to US Census Bureau (2023), it shows that Vietnam’s semiconductor chip exports to the United States reached $562.5 million from $321.7 million in February, up 74.9% in 2022, which accounts for 11.6% of its market share. Besides, Vietnam has recently ranked 3rd in Asia towards semiconductor exports to the US market and Malaysia and Taiwan are in the top two.

Potential for R&D partnerships and tech transfer

Vietnam’s government is actively fostering an environment conducive to research and development (R&D) in the semiconductor sector. The recent establishment of the Vietnam Semiconductor Innovation Centre (VSIC) in collaboration with FPT and supported by major tech companies and universities, including Cadence, Keysight, Tektronix, and Alchip, exemplifies this commitment. Such initiatives aim to accelerate innovation and facilitate technology transfer, enhancing Vietnam’s position in the global semiconductor value chain.

Attraction of global talent and capital

Vietnam’s strategic location, competitive labor costs, and supportive government policies make it an attractive destination for foreign direct investment (FDI) in the semiconductor industry. The government’s ambition to establish at least 100 chip design firms, a fabrication plant, and 10 packaging/testing facilities by 2030 underscores its commitment to building a robust semiconductor ecosystem. This proactive approach is likely to draw global talent and capital, further strengthening the industry .

What’s Next: A Strategic Window for Vietnam under 2025 Trump Tariffs

Short-term Strategies for Vietnam in 3 to 5 years

As Vietnam faces the headwinds of the 2025 Trump tariffs and increasing global protectionism, the country stands at a pivotal crossroads. Amid disruption lies a narrow but powerful strategic window: a 3–5-year period during which Vietnam can cement its role as a key player in the global semiconductor value chain.

Potential Government-Industry Collaboration

Vietnam’s path to semiconductor leadership depends on tight coordination between the public and private sectors.

Recent efforts, such as the launch of the Vietnam Semiconductor Innovation Centre (VSIC) and the Prime Minister’s Decision No. 1018/QD-TTg, signal that the government is serious about supporting the industry. However, successful outcomes will require more

- Infrastructure investment in R&D labs, fabrication plants, and test facilities

- Policy incentives and tax relief to attract high-value foreign direct investment (FDI)

- Regulatory frameworks to ensure stability and ease of doing business for multinational corporations

Key to Invest in Talent, Innovation, and International Alignment

Semiconductor success starts with skilled people. According to the Ministry of Information and Communications, Vietnam will need 50,000–100,000 chip engineers by 2030. Companies like FPT Semiconductor are already taking the lead—with plans to train 10,000 engineers over the next five years, in collaboration with the government.

However, technical training alone will not be enough. Innovation must be embedded in the ecosystem such as funding university research partnerships in chip design and nanotechnology, boosting startup innovation in chip-adjacent fields like AI and quantum computing and fostering public-private R&D collaborations.

Conclusion

While the new U.S. tariffs present geopolitical challenges for many, they offer Vietnam a historic opportunity to ascend in the global semiconductor industry. By fostering robust government-industry collaboration, investing in talent and R&D, and aligning with international markets, Vietnam can transform these challenges into a catalyst for growth.

Stay informed and ahead in this dynamic landscape—subscribe to Our Newsletter for the latest insights and strategic analyses on Vietnam’s semiconductor industry.